Top Insurance companies in India

01 LIC

02 SBI Life

03 HDFC life

04 ICICI Prudential

05 GIC.

In this article we discuss about top insurance companies in India by market cap. Which are listed in Indian stock exchange (NSE &BSE )

01 LIC (life insurance corporation of India )

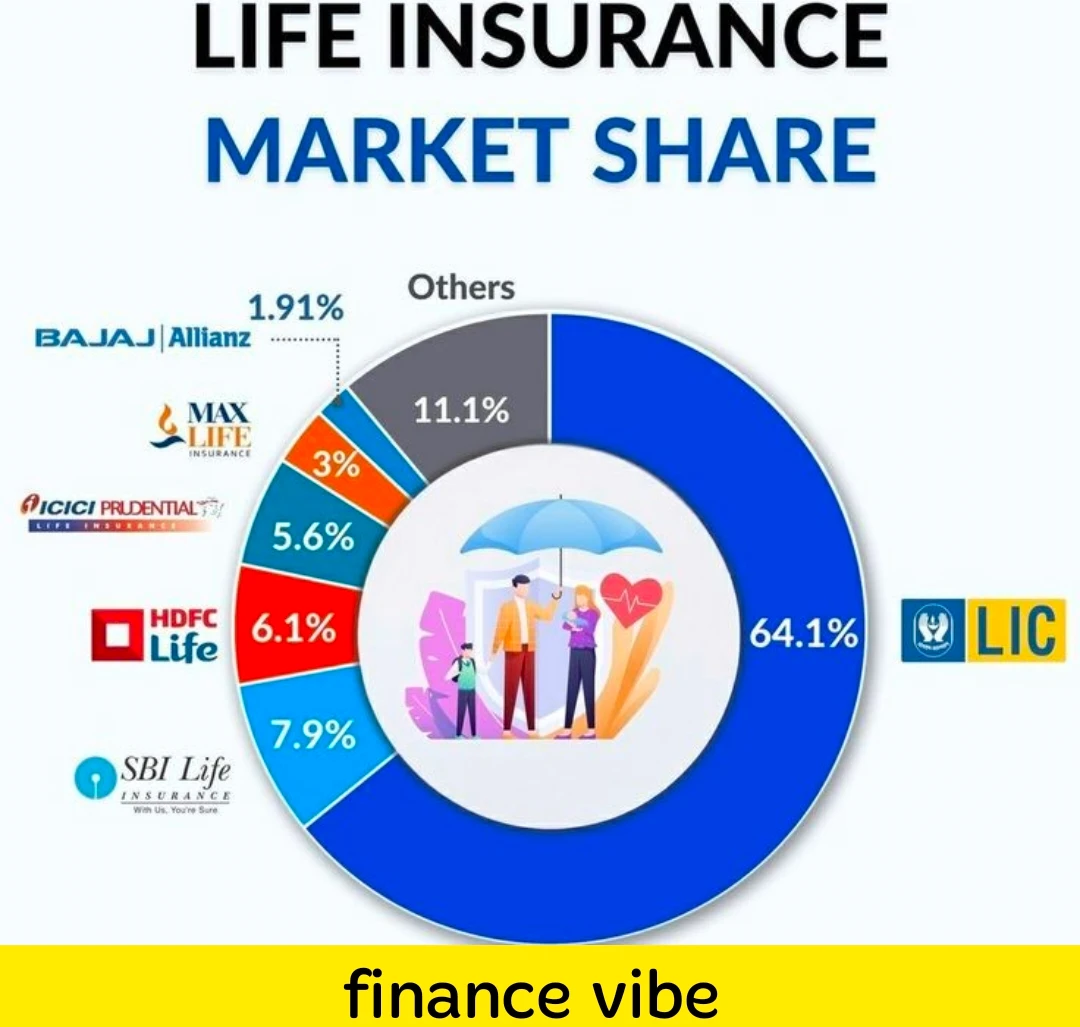

It is the largest player in insurance sector in India by market cap. LIC have 64% of market share of life insurance. LIC is a public sector life insurance company.

Headquarter of LIC in Mumbai. Major promoter of LIC is Government of India and Ministry of finance.

Subsidiaries of LIC

01 LIC pension fund limited

02 LIC Mutual funds

03 LIC card services limited

04 LIC holding finance

05 NSE

LIC provide many services like

life insurance, Term life insurance, Retirement plans, health insurance, investment management, Asset management, index funds, Exchange traded funds, Mutual funds, Risk management

Number of employees work in LIC is 95,700.

Valuation/ fundamentals about LIC

It is a large cap company

01 Market cap – Rs 5,73,266 crore

02 CMP (current market price) – Rs 908

03 P/E – 14.21

04 Dividend yield – 0.33%

05 Cash – Rs 38,353 crore

06 Debt – Rs 0 crore

Share holding pattern of LIC

01 Promoter – 96.50%

02 Mutual Fund – 0.68%

03 DII – 0.18%

04 FII – 0.15%

05 Retail and others – 02.49%

02 SBI Life insurance

It is the second largest player in these sector. SBI life have 7.9% market share of insurance sector. SBI life is a joint venture between SBI (state bank of india) and BNP Paribas cardif

Number of employees – 18,000

Product and services provide by SBI life

Life insurance, term insurance, Endowment policy, Money back policy, Retirement plans

Fundamentals/ Valuation of SBI life

It is a large cap company

01 Market cap – Rs 150,279 crore

02 CMP (Current market price) – Rs 1510

03 P/E – 80.8

04 Dividend yield – 0.17

05 Debt – 0

06 Cash – Rs 4,164 crore

Share holding pattern of SBI life insurance

01 Promoter – 55.42%

02 Mutual fund – 12.33%

03 DII – 03.08%

04 FII – 25.16%

05 Retail and others – 04.02%

03 HDFC Life – it is the third largest player in insurance sector. It has 6.1% market share of these industry. HDFC life is the subsidiary company of HDFC ( Housing development finance corporation limited). HDFC life was founded in 2000. Headquarter of

life in Mumbai (Maharashtra)

Product of HDFC life

Life insurance, term life insurance, Unit linked insurance, Endowment policy, whole life insurance, Retirement plans.

Valuation/ fundamentals about HDFC life

It is a large cap company

01 Market cap – Rs 1,34,240 crore

02 CMP (Current market price) – Rs 625

03 P/E – 88.56

04 Dividend yield – 0.3%

05 Debt – Rs 950 crore

06 Cash – 1,136 crore

Share holding pattern of HDFC life

01 Promoter – 50.37%

02 Mutual fund – 5.77%

03 FII – 30.03%

04 DII – 02.16%

05 Retail and others – 11.66%

04 ICICI prudential – it is the 4th largest player in insurance sector. It has 5.6% market share of insurance industry. It is the subsidiary of ICICI Bank. Basically ICICI prudential joint venture ICICI and prudential corporation holding. ICICI prudential listed in NSE and BSE in 2016. Headquarter of ICICI prudential in Mumbai.

Products/service of ICICI prudential

Life insurance, Term life insurance, investment management, Retirement plans, health insurance

Number of employees – 20,000

Equity divide of ICICI prudential

ICICI (51%) + Prudential (49%)

Fundamentals and valuation of ICICI prudential

It is the large cap company

01 Market cap – Rs 83,762 crore

02 CMP (current market price) – Rs 590

03 P/E – 91.69

04 Dividend yield – 0.1%

05 Cash – 770 crore

06 Debt – 1200 crore

Share holding pattern of ICICI prudential

01 Promoter – 73.24%

02 Mutual fund – 6.43%

03 DII – 2.11 %

04 FII – 13.36%

05 Retail and others – 4.86%

05 General insurance corporation of India (GIC) – it is the 5th largest company in insurance sector. Headquarter of GIC in Mumbai

Product/Services of GIC

Term insurance, health insurance, medical insurance, Retirement plans, whole life insurance.

Subsidiaries of GIC

01 GIC Re South Africa (100% owned by GIC )

Fundamentals/ valuation about GIC

It is mid cap company

01 Market cap – Rs 59,184 crore

02 CMP (current market price) – Rs 345

03 P/E – 9.22

04 Dividend yield – 2.15%

05 Cash – Rs 23,284 crore

06 Debt – 0 crore

Share holding pattern of General insurance corporation of India

01 Promoter – 85.78%

02 Mutual Funds – 0.15%

03 DII – 10.91%

04 FII – 0.86%

05 Retail and others – 2.29%